How to check my default Payment Plan Settings in Pencil

Understanding your default Payment Plan settings in PencilPay helps ensure your customers’ payment plans are set up correctly from the start.

This guide will show you how to quickly review and adjust these default settings, so you can manage plan durations and preferences for all your customers with confidence and ease.

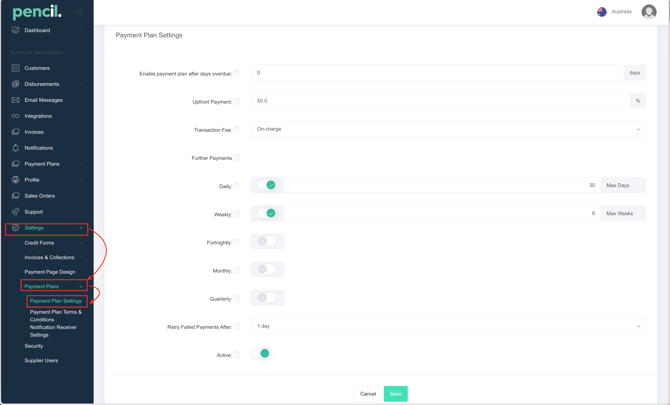

To view your Payment Plan Settings, you can use this link: https://app.pencilpay.com/admin/payment_plan_settings,

Make sure that your default payment plan duration aligns with the duration of the payment plan you will create for your customers.If not, you can always edit, update the maximum duration and hit Save to make certain changes.

In Pencil, go to Settings → Payment Plans → Payment Plan Settings

| Setting | What it Does | How It's Used | Recommended Usage |

|---|---|---|---|

| Enable payment plan after days overdue | Allows plan creation only after an invoice is overdue by a set number of days. For example, 30+ days overdue. | Controls when to offer installment options. Managed in admin settings. | 30 days overdue is a solid baseline. If you don't want to offer payment plans by default we recommend setting this to 90 or 180 days so the payment plan link only shows after an invoice is 90 or 180 days overdue, which it would be worth collecting some funds o these overdue invoices. |

| Upfront Payment | Requires a partial (or full) payment before starting the plan; can be a percentage or fixed amount. | Added as a deposit when a customer starts a plan. | 20–30% upfront is typical. Higher % for risky/large deals; lower for reliable customers as an incentive. |

| Transaction Fee | Determines who pays card/ACH fees: You (absorb), Customer (on-charge), or both (split); fee can be % or flat. | Fee can be set globally or per customer; applies to every plan payment. | Prefer on-charge or split to keep margins healthy. Absorb fees for promos/simple CX, but lowers revenue. |

| Further Payments | Sets frequency of plan installments: daily, weekly, fortnightly, monthly, or quarterly, after the upfront amount. | Choose how often follow-up payments are made on the payment plan. | Weekly is standard and easy to manage. Daily suits high-volume or rapid cashflow. Use fortnightly, monthly, or quarterly for lower admin burden and to match customer cash cycles or preferences. |

| Reset Failed Payments After X Days | Automatically retries failed installment payments after a specified number of days (e.g., 2 days after failure). | If a scheduled payment fails, system waits X days before attempting again. | Recommended: 2–3 days to avoid rapid retries. Adjust based on customer engagement speed and payment reliability. |

Enable payment plan after days overdue

-

What it does:

-

Allows you to create and enable a payment plan only after an invoice is overdue by a set number of days.

-

For example, if set to 30 days, the option to create a payment plan will appear for invoices 30+ days overdue.

-

-

How it's used:

-

Helps you control when customers can be offered installment options, preventing premature extensions before the account is truly overdue.

-

Typically managed in admin settings under Payment Plans.

-

-

Recommended setting:

-

30 days overdue is a solid baseline, as most companies send reminders for the first 30 days, then offer payment plans for invoices not settled by then. Set to 90 or 180 days if you want to reduce who has access to set up their own payment plan.

-

-

Here are bullet points for each PencilPay setting, including what it does and recommended usage:

Upfront Payment

-

What it does:

-

Sets a portion (or the full amount) of the bill to be paid before the payment plan starts.

-

Also known as prepayment or deposit.

-

-

How it's used:

-

Added as an initial required payment when the customer agrees to a plan.

-

Can be set as a percentage or fixed amount.

-

-

Recommended setting:

-

Aim for 20–30% upfront to show commitment and reduce default risk.

-

For very large or risky transactions, higher upfront payments are recommended.

-

For reliable customers, you may offer a lower upfront payment as an incentive.

-

Transaction Fee

-

What it does:

-

Allows you to decide whether to absorb, pass on, or split card/ACH transaction fees with customers.

-

Absorb: You pay the fee

-

On-Charge: Customer pays entire fee

-

-

How it's used:

-

Fees can be a set percentage or flat amount, applying to every payment processed in the plan.

-

-

Recommended setting:

-

![200707 pencil-logo-white-green-white_background-square.png]](https://support.pencilpay.com/hs-fs/hubfs/200707%20pencil-logo-white-green-white_background-square.png?width=150&height=53&name=200707%20pencil-logo-white-green-white_background-square.png)